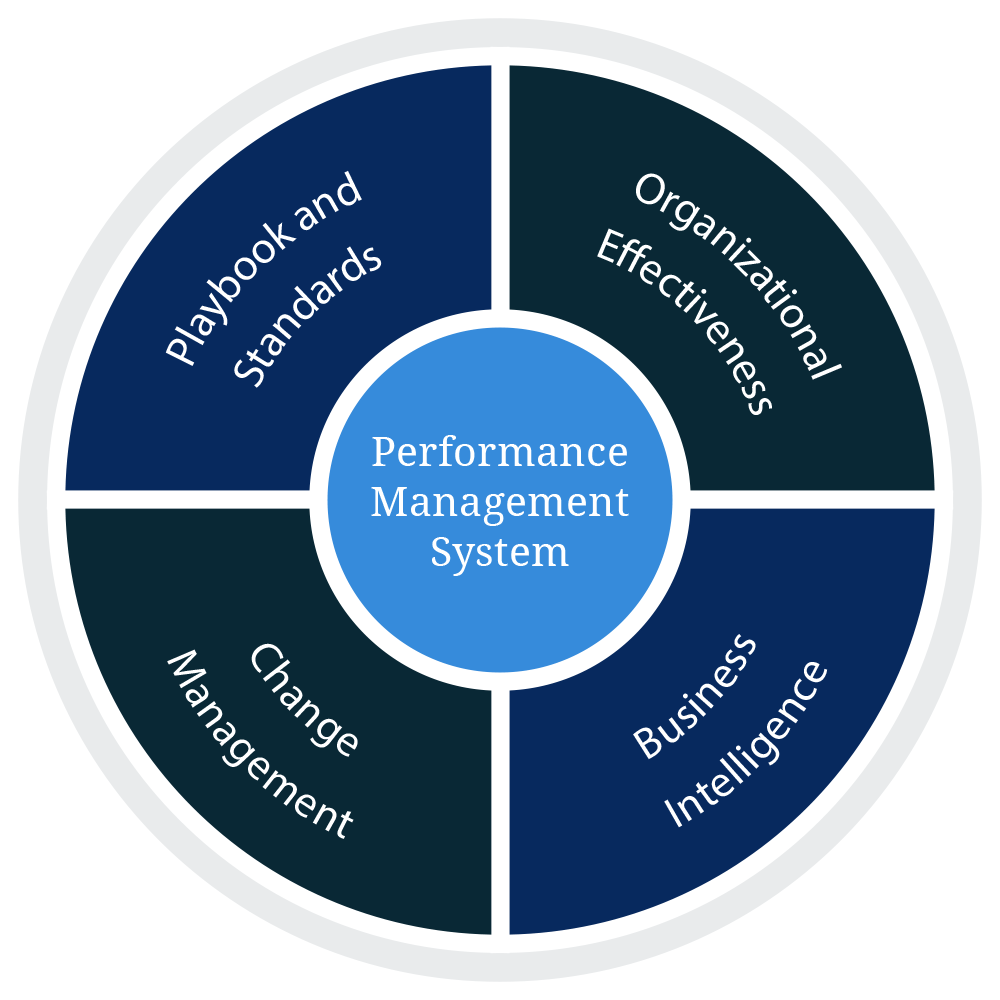

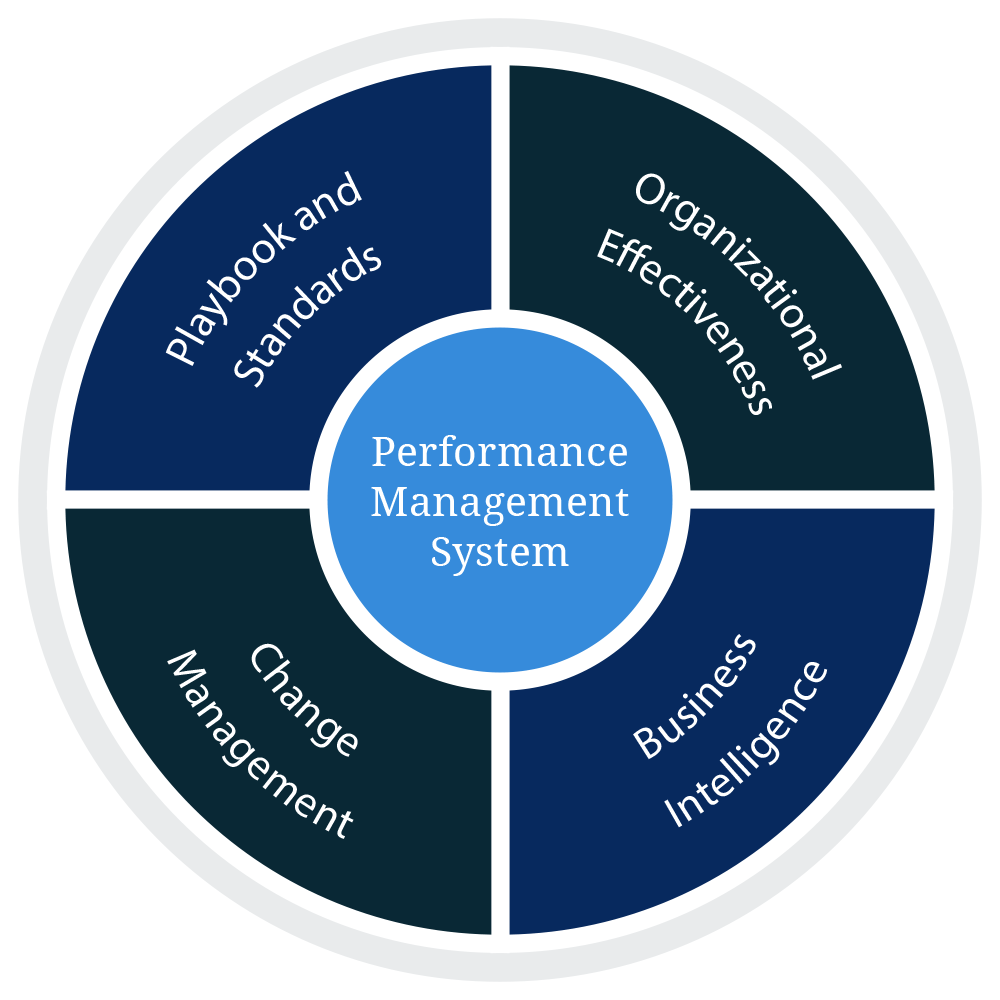

Performance management systems (PMS) play a critical role in helping strategic employees align their individual efforts with the broader goals of the organization. By setting clear expectations and defining specific, measurable objectives, PMS ensures that strategic employees understand how their work contributes to the company’s long-term success. This alignment provides them with a sense of purpose, helping them focus on key tasks that drive organizational performance and growth.

Additionally, PMS fosters continuous feedback and development, which is essential for high-performing employees. Regular performance reviews and check-ins enable employees to receive timely feedback, recognize areas for improvement, and identify opportunities for skill development. This not only enhances their current capabilities but also prepares them for future roles, ensuring that they remain agile and adaptable as organizational needs evolve.

Moreover, PMS supports employee motivation and engagement by recognizing and rewarding achievements. Strategic employees who meet or exceed performance expectations are often rewarded with promotions, bonuses, or new career opportunities. This system helps retain top talent by demonstrating that their contributions are valued, motivating them to maintain high levels of performance. Through personalized development plans and data-driven insights, PMS also helps identify high-potential employees, paving the way for leadership development and succession planning.

Ultimately, performance management systems enable strategic employees to take ownership of their goals, increase their accountability, and continuously improve their performance. By providing structure, support, and recognition, PMS empowers these employees to contribute meaningfully to the organization’s strategic vision, ensuring both individual growth and organizational success.